Today we will deal with a metric that is as meaningful as controversial. Why? Try to google ROCE in property investment. Some people swear on it, even arguing that ROCE and yield are the only investment metrics that matter. Some experienced investors consider ROCE to be identical to ROI, so they disregard it. SWORP Rent doesn’t belong to any of these parties. We have a thing for useful tools, and we believe that having the ROCE in your toolbox and using it collaboratively with other investment metrics is the best way to apply it. In this case, specifically to evaluate your entire investment properties portfolio.

Today we will deal with a metric that is as meaningful as controversial. Why? Try to google ROCE in property investment. Some people swear on it, even arguing that ROCE and yield are the only investment metrics that matter. Some experienced investors consider ROCE to be identical to ROI, so they disregard it. SWORP Rent doesn’t belong to any of these parties. We have a thing for useful tools, and we believe that having the ROCE in your toolbox and using it collaboratively with other investment metrics is the best way to apply it – in this case specifically to evaluate your entire investment properties portfolio.

What do you need to know to work the ROCE out? The net income in the first place. To do that, take the gross rent per year figure and deduct any cost of ownership (e.g. insurance, Wi-Fi, cleaning, repairs, etc.), but not interest and tax. The number you end up with is EBIT. This stands for Earnings Before Interest & Tax.

Second, you need to know the figure of capital employed – cash bound in your properties, including ALL costs and fees you’ve incurred. In other words, you subtract the current liabilities of your properties from the total assets of your properties. As this number must be very accurate (because we are chasing the NET figure), be sure to subsume expenses such as surveys, searches, selling costs, solicitor’s fees, taxes, removals, refurbishment, and deposit, valuation, mold inspection, pigeon disposal, etc.

Here’s the formula:

Similarly to ROI, ROCE is a very versatile metric, but it’s more specific to the overall property business you run – for example, if you have a portfolio of multiple properties. Unfortunately, even experienced property investors tend to confuse ROC and ROCE all the time or even think it is the same thing. Only in the case of individual property, ROCE is the same as ROI.

Therefore, the use of ROI and ROCE shall be different. You can use it for example even for deals which you are not buying, such as rent to rent.

Unlike the ROCE, ROI is a bit more flexible. It can be used to compare products, projects, and various investment opportunities you consider.

The advantage ROCE holds above ROI is that ROI only looks at the cash you are putting in, while ROCE covers the whole capital including loans and mortgages, so ROCE number will be lower than ROI.

Also, ROCE covers the major downside of ROI – it doesn’t take the factor of time into account. An investment can have the same ROI, yet one can provide that return in a year, while another takes two, three, or even more years. The ROI calculation also doesn’t consider fees or taxes.

When to use ROCE? If you have multiple properties, ROCE will be the best way to evaluate your portfolio.

Let’s sketch an example:

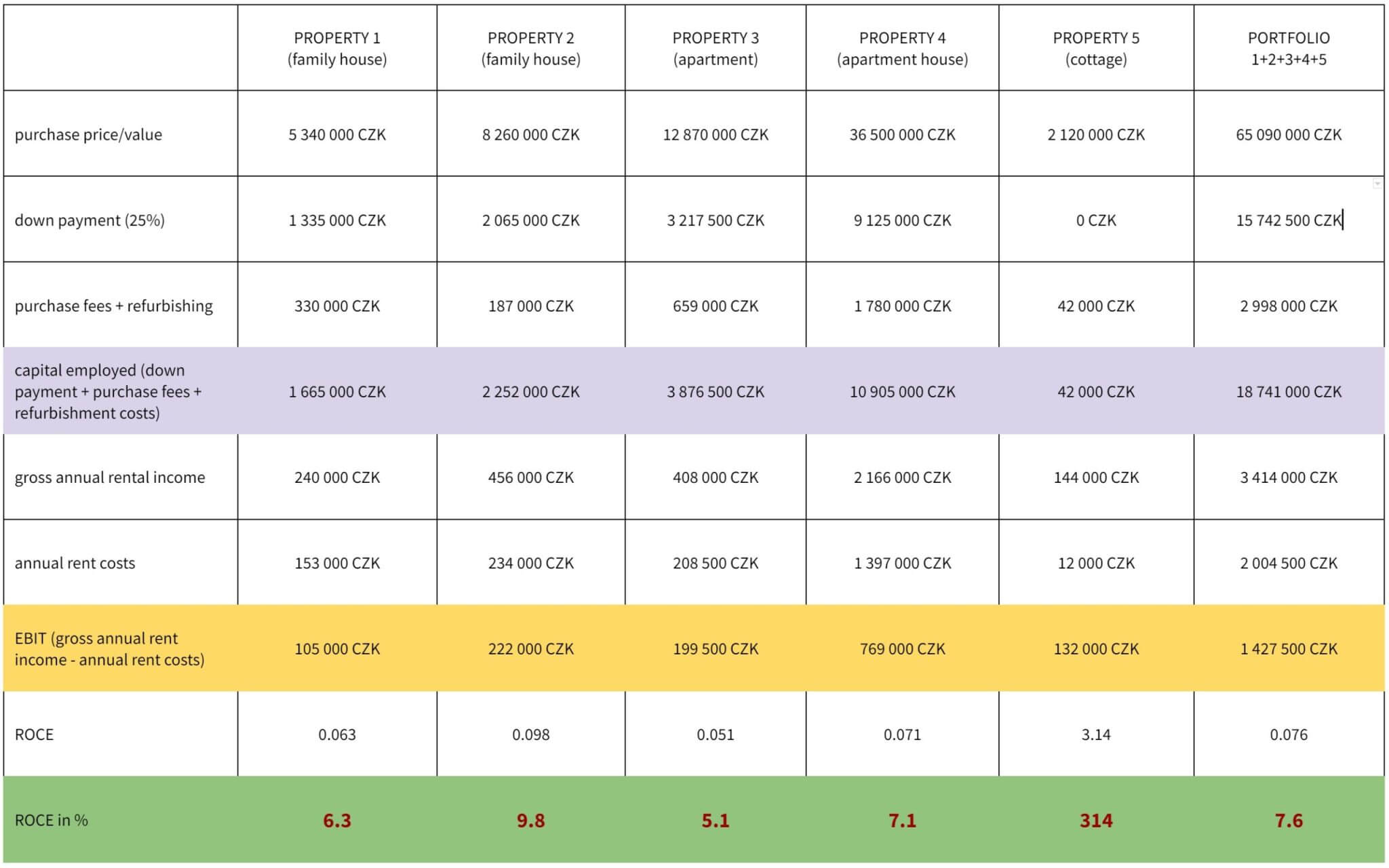

My investment portfolio consists of five properties (all in Czechia). Each property generates certain net income per year. Each property needs refurbishment – some of them very thorough. Four properties have a certain amount of down payment for mortgage (25%), one’s purchase price was paid out of my pocket. It’s chart time!

What does the chart say? Property 3 has the lowest return. This year the apartment returns 5,1% of capital I put into it. If this trend continues, it would take around 20 years to get the cash I employed back. On the flip side, look at property 5, the cottage. I purchased it from my own pocket, no mortgage, no big remodeling was needed. Cottage’s ROCE is 314%. Incredible? Not really. It will take approximately 4 months to get the money I put in back. Sounds great, but don’t forget it’s not the 314% of the purchase price, but of down payment (which was none), purchase fees and renovation /maintenance costs (which were minor compared to the purchase price of the cottage).

Let’s look at the overall portfolio performance from the perspective of ROCE: Total EBIT/Total Capital Employed.

The figure is 0,76. Let’s get the percentage (multiply by 100): ROCE is 7,6%.

My imaginary portfolio of five properties returns 7,6% of the money I put into it this year. The cottage didn’t really raise the ROCE figure, because compared to the more valuable properties, it is a drop in the ocean. Still, the overall return generation might be considered both positive and negative, depending on your future plans with properties. Remember that renovations may raise the value significantly, even if the current numbers seem desperate at first glance.